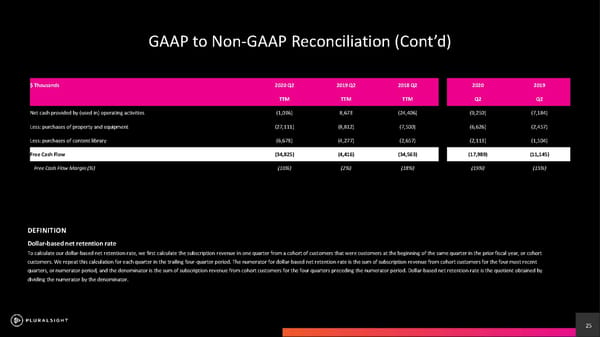

25 DEFINITION Dollar - based net retention rate To calculate our dollar - based net retention rate, we first calculate the subscription revenue in one quarter from a cohort of cu stomers that were customers at the beginning of the same quarter in the prior fiscal year, or cohort customers. We repeat this calculation for each quarter in the trailing four - quarter period. The numerator for dollar - based net r etention rate is the sum of subscription revenue from cohort customers for the four most recent quarters, or numerator period, and the denominator is the sum of subscription revenue from cohort customers for the four quar ter s preceding the numerator period. Dollar - based net retention rate is the quotient obtained by dividing the numerator by the denominator. GAAP to Non - GAAP Reconciliation (Contd) $ Thousands 2020 Q2 2019 Q2 2018 Q2 2020 2019 TTM TTM TTM Q2 Q2 Net cash provided by (used in) operating activities (1,036) 8,673 (24,406) (9,250) (7,184) Less: purchases of property and equipment (27,111) (8,812) (7,500) (6,626) (2,457) Less: purchases of content library (6,678) (4,277) (2,657) (2,113) (1,504) Free Cash Flow (34,825) (4,416) (34,563) (17,989) (11,145) Free Cash Flow Margin (%) (10%) (2%) (18%) (19%) (15%)

Pluralsight Investor Presentation Page 24 Page 26

Pluralsight Investor Presentation Page 24 Page 26